How Much is that Mello-Roos? A Comprehensive Guide on Mello-Roos in San Francisco Real Estate

If you are considering buying a home in San Francisco, budgeting for your monthly housing payment will include budgeting for property taxes.

The Transbay Transit Center and adjacent Salesforce Tower

The primary determinant of your tax bill will be the purchase price of your property, which is taxed at about a rate of .0118%/year. A substantial addition to these bills for some homes in San Francisco comes from the addition of Mello-Roos taxes for Community Facilities Districts (CFDs). But what exactly is the history behind Mello-Roos and why is it important?

What is Mello-Roos?

Mello-Roos is a form of property taxation in California, introduced by the Mello-Roos Community Facilities Act of 1982 and named after its legislators, Senator Mello and Assemblyman Roos. The law allows local governments to create Community Facilities Districts (CFDs) to levy taxes to fund public services and infrastructure.

Purpose: Mello-Roos taxes are levied to finance community services, infrastructure improvements, and public services like parks.

Duration: Mello-Roos taxes are typically levied for a set period of time, which can be as long as 40 years.

Payment: Paid with the property tax bill.

Understanding Mello-Roos is crucial for homebuyers and property owners in San Francisco, as it affects property taxes and the value of real estate investments in designated areas.

Mello-Roos or Community Facility District?

Yes. Now we know the creation of a special tax community facility district is enabled by a law known as Mello Roos. Mello Roos taxes are never actually called Mello Roos taxes, but generally some specific type of Community Facilities District or CFD. So Mello-Roos = CFD = Community Facilities District.

The Substantial Addition to Some Property Tax Bills for Some Homes in San Francisco

We’ve written elsewhere about property taxes in general, but this post is about specific addition(s) to your property tax bill in San Francisco created by Mello Roos tax districts. That’s It.

There are other additions to a SF tax bill. The SF Assessor has a great property tax portal where you can lookup any SF property and see a detailed breakdown of property tax bills, including the assessment of parcel-specific Mello-Roos taxes as well as other direct or special assessments. This post is not that, though. Nor is it a substitute for required tax disclosures or professional tax planning, just a shameless wormhole because someone asked us a question and what sounds simple actually turns out to be… San Francisco real estate!

How are Community Facility District/Mello-Roos Tax Areas Created?

A Community Facility District/Mello-Roos tax districts can blanket any area of land, with the only requirement being that at some point in time at least a majority of the property owners within the area voted to put the Mello-Roos special tax obligation on the area of land (alternately, a County Board of Supervisors can also create one). Tax obligations burden the property regardless of owner, so Mello-Roos tax districts become the obligation of current and future homeowners (perhaps you!) in Mello-Roos tax districts for a period of time that can be years but is typically decades.

To avoid the California constitutional ban on property tax increases created by Prop 13, Mello-Roos taxes are not based upon the value of the property but some other characteristic, in some cases equally per parcel and in other cases based upon an objective measurable characteristic such as square footage, height of building, or other determinant. And in some cases all of the above.

In San Francisco, several Mello-Roos Community Facility District Special Tax Areas were created by various redevelopment agencies that are now defunct but administered by the SF Office of Community Investment and Infrastructure (OCII).

What Do Community Facilities Districts Pay For?

Infrastructure, in one word. Infrastructure & Ongoing Maintenance in a few more words. And to get even more descriptive: wastewater/sewage systems, parks, streets, sidewalks, police stations, firehouses, ambulances, an electricity distribution grid, and all the other very-necessary and never-sexy requirements for a well-functioning neighborhood, of which San Francisco has around ninety (well-functioning neighborhoods, that is).

It’s a real estate specific application of the chicken or egg dilemma. Mello-Roos taxes are typically approved by a redevelopment agency before the residents that will pay the taxes live there. Private developers won’t build homes until they can connect their homes to sidewalks, streets, and sewers. And buyers won’t buy those homes until there are parks and schools in the neighborhood. Mello Roos is one way to pay for the infrastructure needed for people to live there before the people live there to pay for the infrastructure they need.

Mello Roos is the proverbial egg that pays upfront for the un-sexy infrastructure (sewers, roads, sidewalks) that private developers need to connect their new market-rate and below-market-rate developments to. It also pays for the public common good amenities like parks, open spaces, and trails that are of public benefit and residents expect. Once built, anyone can cross that proverbial street (with or without chickens underarm) to an actual sales office and make a real offer to purchase in a community hatched from the Mello Roos egg.

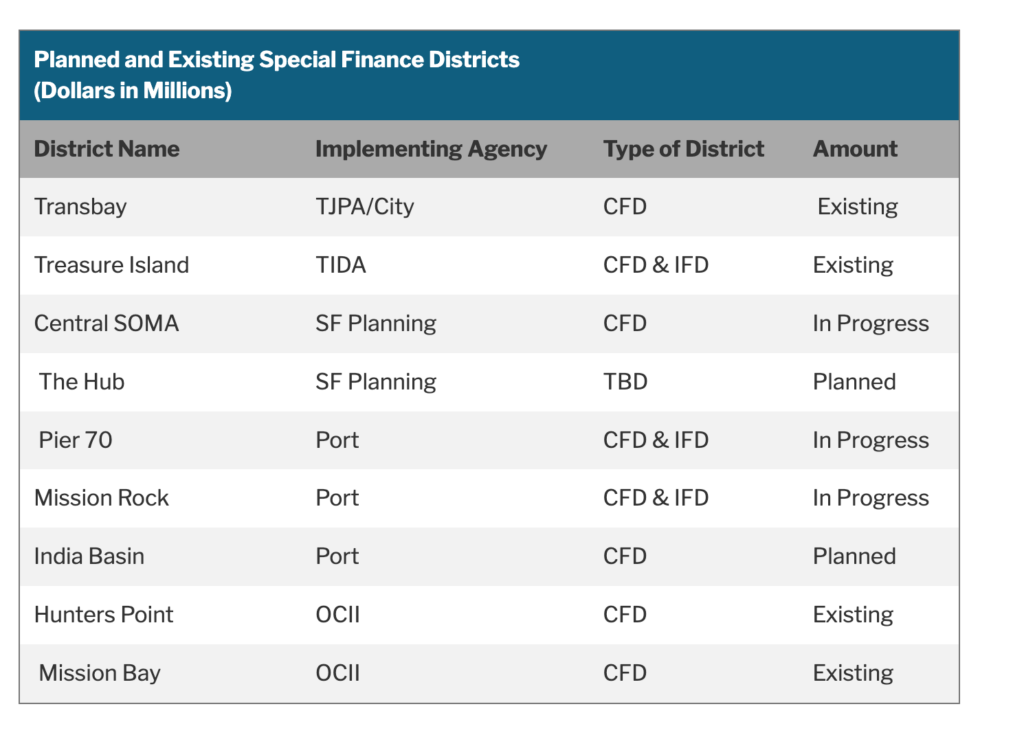

Does San Francisco Have Mello-Roos Tax Districts?

Yes. San Francisco has many Mello-Roos districts, some that overlap, many that don’t. Some Mello-Roos special tax assessment amounts are relatively small, while others can add more than $20,000/year to a property tax bill. Here are Mello-Roos Tax Districts in San Francisco to know about when you own a home in San Francisco.

All of San Francisco Pays a Minor Mello-Roos Tax for SFUSD

After the Loma Prieta earthquake of 1989, SF voters decided to tax themselves with a Mello-Roos tax to pay for the rebuild and seismic upgrade of SFUSD schools. The SFUSD Mello-Roos tax is about $40.52/year for each tax parcel in San Francisco and is currently set to expire around 2031. This is the minor Mello-Roos tax assessment all property tax owners in SF pay. Read on for the larger ones.

Areas of San Francisco with Additional Mello-Roos/CFD Taxes

The Transbay Transit Mello-Roos District

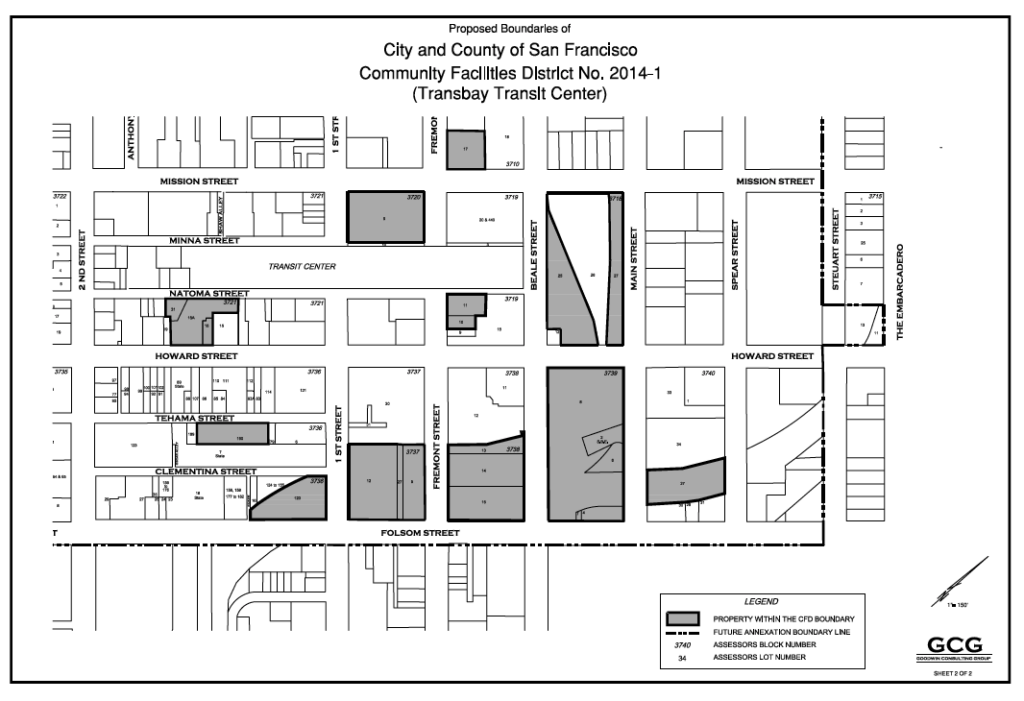

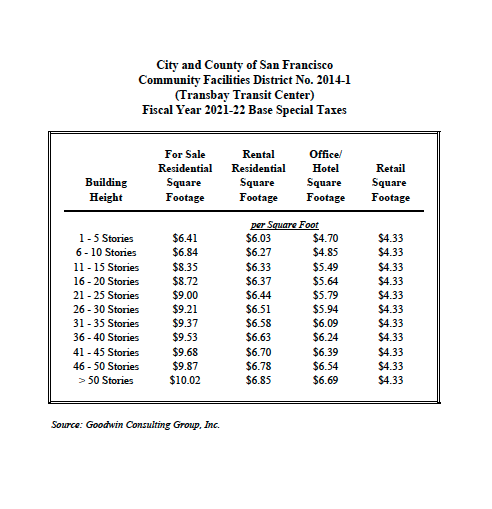

What: The Transbay transit Mello-Roos district was approved by the SF Board of Supervisors in 2014 to pay for improvements to infrastructure in the transbay area, primarily the construction of the Transbay Terminal. The transbay transit Mello-Roos tax is paid only by certain parcels near the transbay transit center in San Francisco. On a San Francisco Multiple Listing Service Map you would find these buildings in the Yerba Buena, SOMA, or South Beach neighborhoods. There are different Mello-Roos tax rates for the various property uses (residential, commercial, hotel), and various rates for each property type based on the height of the building in this area. Many of the residential buildings assessed Transbay CFD taxes were not in existence at the time the tax was approved.

Expires: about 2054

How Much: For the residential buildings impacted by it, it adds between $9 – $10/year per square foot to your tax bill. On a 1,000 square foot condo, that’s $9,000 – $10,000 year in addition to your base property tax rate computed from your purchase price.

Residential Buildings in the Transbay Transit Mello-Ross CFD:

Transbay CFD Buildings

Mira at 280 Spear, The Avery at 488 Folsom, 181 Fremont, and One Steuart Lane

Base and Incremental Tax Rates for Transbay Area

Hunter’s Point / The Shipyard / Candlestick Point Community Facility Districts

What: There are several various CFDs that were created during the redevelopment (actual or still proposed) of the Hunter’s Point Naval Shipyard and Candlestick Point areas. These are found on San Francisco property tax bills as CFD#7 Hunters Point Shipyard Phase 1, CFD#8 Hunters Point Shipyard Phase 1, CFD#9 Hunters Point Shipyard Phase 2/Candlestick Point. For the admin wonks out there, these are all administered by OCII as of 2023.

CFD#7 and CFD#8 for Hunters Point Phase 1 affects about 66 acres of hilltop and adjacent land in the southeast area of San Francisco that was once a part of the Hunter’s Point Naval Shipyard. When the naval base closed, the land was transferred to the city and county of San Francisco for redevelopment. The city of SF partnered with Lennar as the primary developer for the neighborhood. How the taxes came to be is complicated, but the result is essentially an additional per-parcel tax for each residential parcel in what has now been branded The Shipyard.

CFD#9 affects parts of the Shipyard not yet developed as of 2023 as well as all of the undeveloped-as-of-2023 Candlestick Point project.

The Shipyard. Photo credit Matt Fuller

Expires: Around 2045

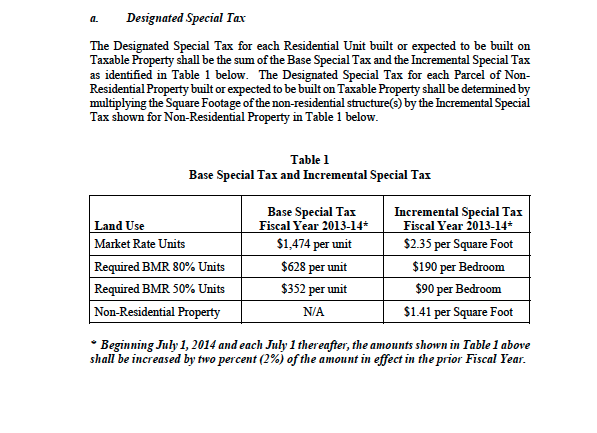

How Much: All parcels are charged a base rate and then an additional amount based on the square footage of the property for market rate homes or the number of bedrooms for below-market-rate homes. In 2023, it is about $1,800 per home base rate and an additional $2.86/square foot. For a 1,000 square foot condo, that’s about $4,660/year in addition to your base property tax rate computed from your purchase price.

Base and Incremental Tax Rates for Hunters Point Shipyard Phase 1

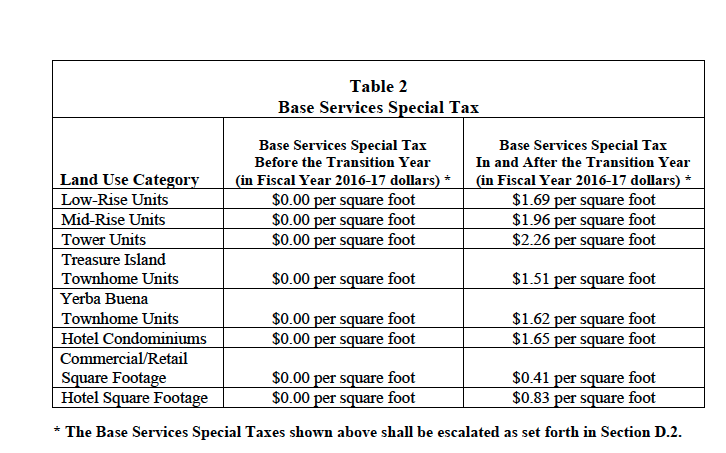

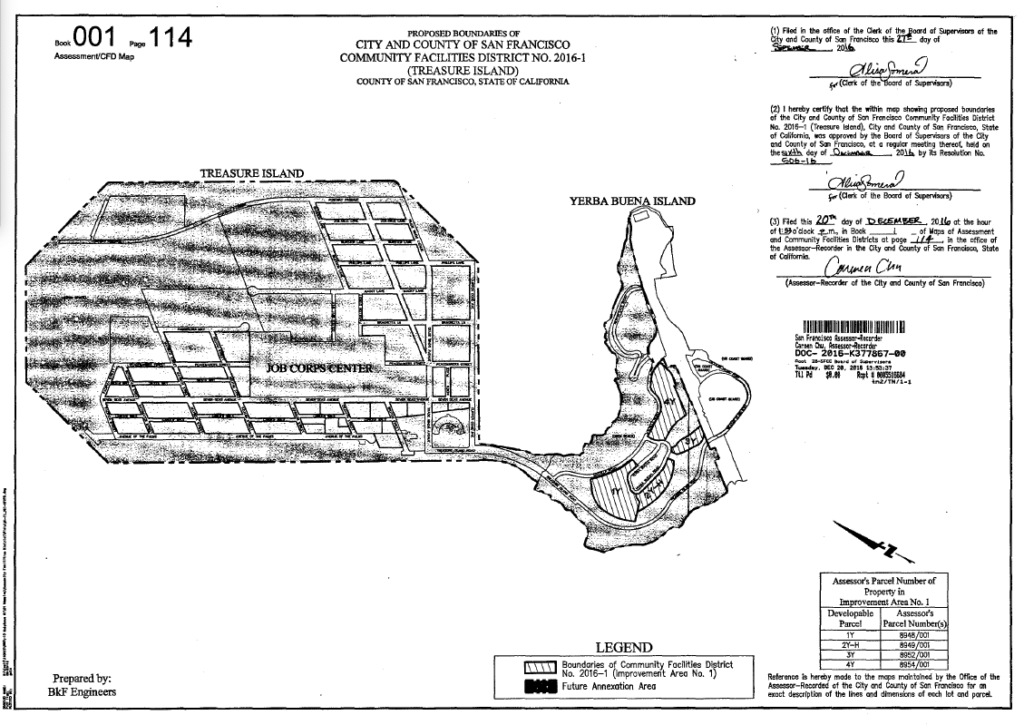

Treasure Island/Yerba Buena Island

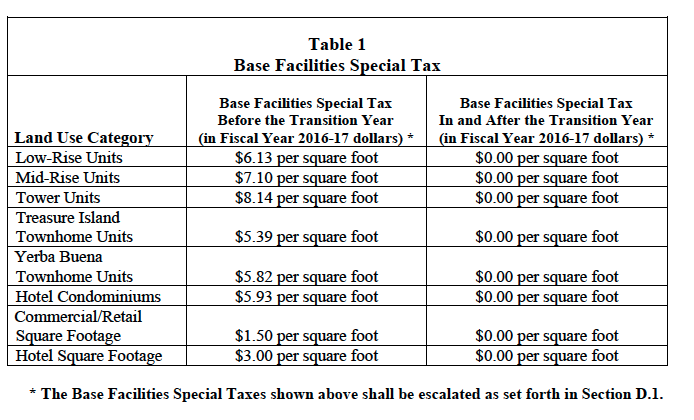

What: Affecting all of Treasure Island and Yerba Buena Island, this Mello-Roos tax district pays for the creation of all the public infrastructure on the islands, including things like wastewater, sewage, roadways, parks and so forth. The rate varies based on the type of property and is based upon square footage. The Yerba Buena Island and Treasure Island Mello-Roos CFD refers to a “transition year” which is essentially the year that all of the debt taken out to pay for the community improvements has been paid back. At that time the tax transitions to a much lower rate. That transition year is far in the future, so focus your math on Table 1 which contains the base tax rate until that happens.

Expires: Around 2050

Residential Buildings in the Yerba Buena Island/Treasure Island Mello-Ross CFD:

TI & YBI Buildings

The Bristol at Yerba Buena Island

How Much: Rates on Treasure Island/Yerba Buena are based on building style and square footage. At a mid-rise building like The Bristol, in 2023, the rate is about an additional $8.16/square foot. For a 1,000 square foot condo, that’s about $8,160/year in addition to your base property tax rate computed from your purchase price.

Mission Bay Community Facility Districts

What: While it’s known as Mission Bay, it was redeveloped as Mission Bay North and Mission Bay South. For the curious, the delineator is the Mission Bay Channel. The first area of Mission Bay to be redeveloped was north of the channel, followed by the area south of the channel to the neighborhood’s southern boundary at 16th Street. On a SF Property Tax Bill you’ll find these variously described as CFD#4 Mission Bay North, CFD#5 Mission Bay North & South, and CFD#6 Mission Bay South.

A view of The Arden South of Mission Bay Channel

Residential buildings in all of Mission Bay on a SF MLS Real Estate Map are generally subject to CFD#5, which is essentially a per-parcel maintenance tax for the Mission Bay open space. The Mission Bay neighborhood contains a north CFD taxed at one rate and a south CFD taxed at a separate rate, as well as the overlapping Mission Bay CFD. Depending on where you live in Mission Bay you’ll likely pay either special taxes for CFD 4 and 5 or 5 and 6 but not all three and in some buildings, just CFD 5.

Buildings north of the channel may pay CFD#4, Mission Bay North in addition to Mission Bay CFD#5. Residential buildings north of the Mission Bay Channel in the Mission Bay redevelopment area are The Beacon, The Arterra, 255 Berry, 235 Berry, The Glassworks, and Park Terrace.

Mission Bay Buildings

Buildings south of the channel may pay CFD#6 Mission Bay South in addition to CFD#5. Residential buildings south of the channel are The Madrone, The Radiance, The Arden, and One Mission Bay.

Expires: Around 2040

How Much: Rates in the various Mission Bay CFDs are generally based upon square footage, and how that amount per square footage was arrived at is… complicated. At a market rate building like The Madrone, in 2023, the rate is an additional $8.16/square foot. For a 1,000 square foot condo, that’s about $8,160/year in addition to your base property tax rate computed from your purchase price.

Pier 70 CFD

The Dogpatch

What: xxx

Expires: ??

How Much: When market rate homes are for sale in the development, we will update this post.

Mission Rock CFD

From Parking Lot to Mission Rock Neighborhood

What: xxx

Expires: ??

How Much: When market rate homes are for sale in the neighborhood, we will update this post.

Other Community Facility Districts in San Francisco

The India Basin area as well as The Hub at Market area are both also areas where the city has plans for a future CFD, but we have no additional information about them as of this writing in November of 2023.

Navigating San Francisco’s Real Estate with Jackson Fuller

Knowing where you’ll find Mello Roos and where you won’t is another reason to embark on your San Francisco home journey with help from Jackson Fuller Real Estate.

Our team is deeply versed in the city’s unique real estate dynamics, and is dedicated to delivering tailored services that align with your individual preferences and requirements. Whether you’re buying or selling, we’ll seamlessly navigate you towards your ideal property.

Start your journey towards finding your dream home by connecting with us today.