List of Assumable Loans in San Francisco

Hi there! You’ve read the NY Times article about assumable mortgages or something similar. You’ve read that they were last popular so long ago that most real estate agents don’t even know about them. And that there are vast pools of assumable loans out there, and that maybe you can make your next home more affordable by scouring the records for assumable loans.

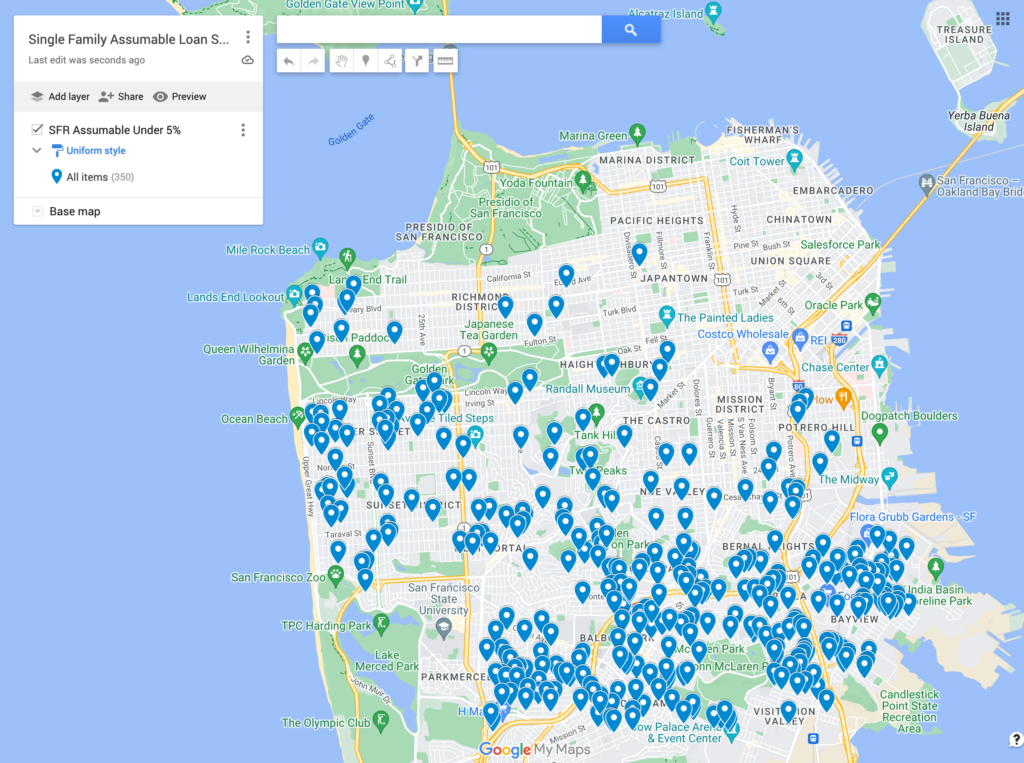

About 400 Single Family Homes in San Francisco Likely to Have Assumable Mortgages Under 5%. Contact Us For Details.

At Jackson Fuller, we know about them and can help you understand if they can help you afford a home in San Francisco.

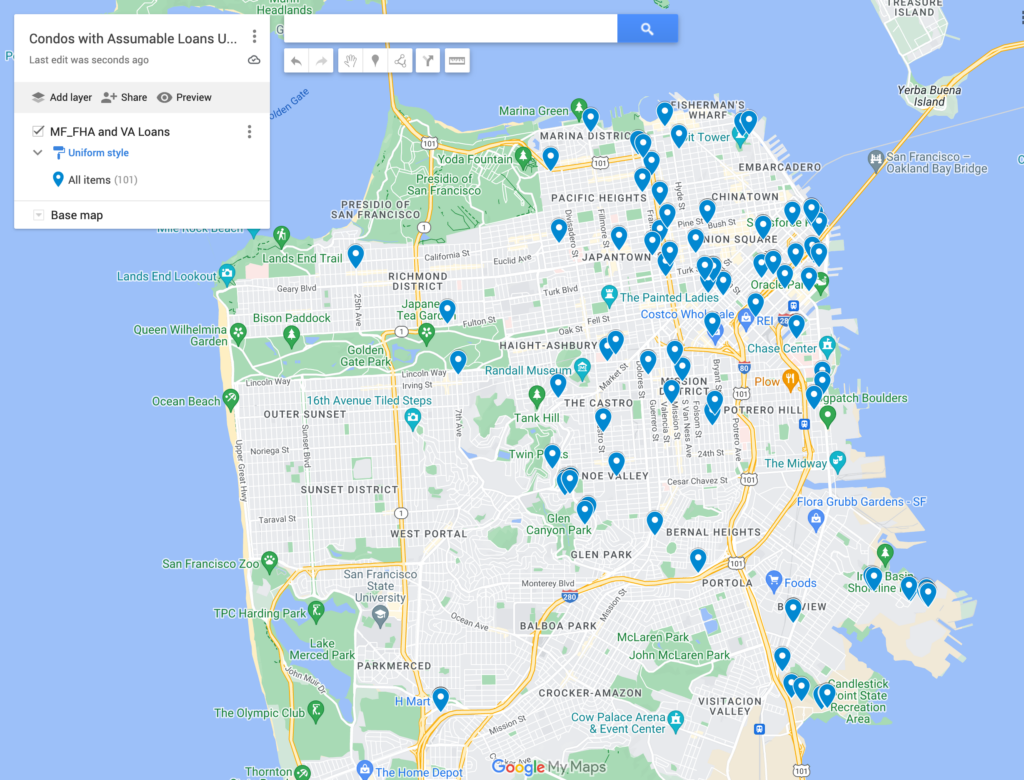

About 100 Condo Homes in San Francisco Likely to Have Assumable Mortgages Under 5%. Contact Us For Details.

Garfield, A Veteran. Golden Gate Park, San Francisco. Photo Copyright JFRE.

What kind of Loans Are Assumable?

There are two loan types that generally have an assumability feature. These two loan types that usually have an assumability clause are known as FHA loans and VA loans. Yes, there are thousands and thousands and thousands of these loans that have been issued. However, there are not a lot of these loans issued in San Francisco. And even fewer with interest rates under 5% or otherwise low enough that assuming the loan is attractive.

FHA Loans

FHA loans are often issued to first time buyers who have less than a 20% down payment and/or less than stellar credit scores. FHA loans with smaller down payments will include Private Mortgage Insurance (PMI) through their FHA loan. PMI is not generally deductible from taxes.

Sunset in Golden Gate Park, San Francisco. Photo Copyright JFRE.

FHA loans can be issued on single family or condo homes, but if it is a condo then the FHA must approve the condo development. The FHA will look at building condition and HOA health when determining if they will approve a development. FHA approval for a condo development is for several years and must be renewed on a regular basis if new FHA loans are to be issued in the condo development.

In 2024, the maximum loan amount for a FHA loan is just over $1,000,000.

VA Loans

VA loans are issued by the Department of US Veteran Affairs, and as you might infer from the issuing department, these are loans issued to veterans. These loans don’t require a down payment and have favorable interest rates and terms compared to what is available on the open market.

Since being a veteran is a pre-requisite for these loans, they are available to a fairly small overall segment of the population. While you must be a veteran to qualify for the original VA loan, you do not have to be a veteran to assume a VA loan.

Photo Copyright JFRE

VA loans can be underwritten on single family or condo homes, but the underwriting rules and requirements for condos are burdensome enough that we have seen very few (we could count them on one hand) VA condo loans in our decades of San Francisco real estate experience.

In 2024, the maximum loan amount for a VA loan is about $1,150,000.

FHA and VA Loans in San Francisco

There are very, very few FHA and VA loans issued in San Francisco county. How many? Of the hundreds and thousands of homes that exist in San Francisco, there are about 500 loans that are FHA or VA loans with an interest rate of under 5%.

Photo Copyright JFRE

Why are there so few? Because the underwriting process and program requirements for these loans don’t align with the most common demographics or needs of San Francisco home buyers. San Francisco home buyers tend to have a down payment and good credit, and choose to structure their home loans in a way that avoids PMI. SF home buyers also typically need a mortgage broker that can move extremely fast, and that does not describe the approval process for either a FHA or VA loan.

We have the list if you want to pursue working together on buying (assuming) a loan and the house that comes with it.

Does Assumption of A Loan Require Approval?

Yes. The existing lender will get a loan application from the buyer with the purpose of assuming a specific loan. While a lender can’t unreasonably approve the assumption, they also aren’t required to quickly respond. Getting the assumption approved and through the existing lender can take time and effort, it is not an automatic process.

Can I Get A Second Loan When I Assume a Mortgage?

Yes. The size of the loan that is being assumed cannot be changed. If the loan was for $400,000, you can assume what remains of that loan, but the lender will not lend you more on that loan at that rate. This typically means you’ll need a large down payment to make up the difference between loan size and your purchase price, or that you’ll need to get a second loan to make up the difference. The second loan will be issued at current market rates.

Is This A Viable Strategy in San Francisco

FHA and VA loans make up a very, very, very small portion of loans issued for San Francisco homes in the past decade. There are about 500 of them across San Francisco, and they are typically clustered in neighborhoods popular with first time buyers on a budget.

How Many Assumable Condo Mortgages in San Francisco Are There?

Our search of the records indicate there are about 100 condo homes in developments that were FHA or VA approved and are likely to be assumable by a current buyer. Not all of these projects continue to have FHA or VA eligibility, so the actual number is probably less. If you’d like to explore the list, get in touch.

How Many Assumable Single Family Home Mortgages in San Francisco Are There?

Our search of the records indicate there are about 400 single family homes across the city with an FHA or VA loan that is likely assumable by a current buyer. These homes are primarily located on the west, south, and southeast areas of the city. On a SF real estate map that corresponds with districts 2, 3, and 10. If you’d like to explore the list, get in touch.

Next Steps to Get The List of Assumable SF Loans

Ready to browse the list of assumable loans in San Francisco? Contact Jackson Fuller Real Estate today for a free consultation and discover how our expertise can turn your buying journey into a success story.