The Estimated Settlement Statement

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

In San Francisco, title insurance companies typically act as the escrow agent for a residential real estate purchase/sale, and the escrow officer prepares the statement with input from the buyer’s lender (if applicable) and other parties with financial interest in the closing. Estimated settlement statements look pretty similar between escrow/title companies in the bay area, and we’d like to thank our friends at Old Republic San Francisco for a sample estimated buyer settlement and estimated seller settlement statement.

Note: The estimated settlement statement is not the same document as the Closing Disclosure. The fees/costs seen on a buyer’s Closing Disclosure are the same fees and costs you will see on the estimated settlement statement displayed in a different way.

Let’s take a look at each section of the estimated settlement statement document in closer detail.

Two Separate Views of the Same Transaction

The buyer’s view of an estimated settlement header

The seller’s view of an estimated settlement header

The top of the document will contain the relevant information for each party, as well as the property location (people have sold the wrong house before, believe it or not) estimated settlement date (no joke) and your escrow officer at the title company. The documents will also both generally start with the same item – the sales (purchase) price, and from there each document diverges to share the relevant information to each party. We begin the the estimate for the buyers, feel free to skip ahead to the seller estimate.

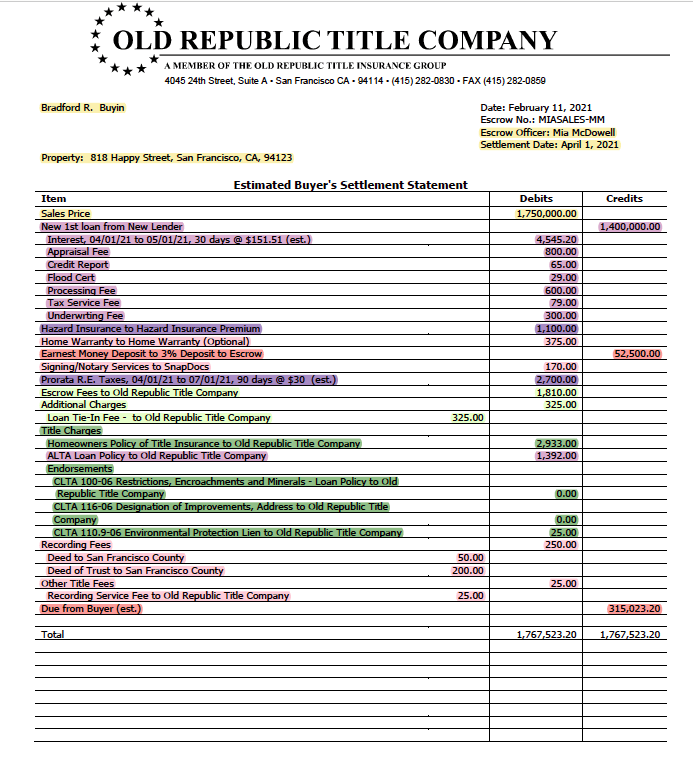

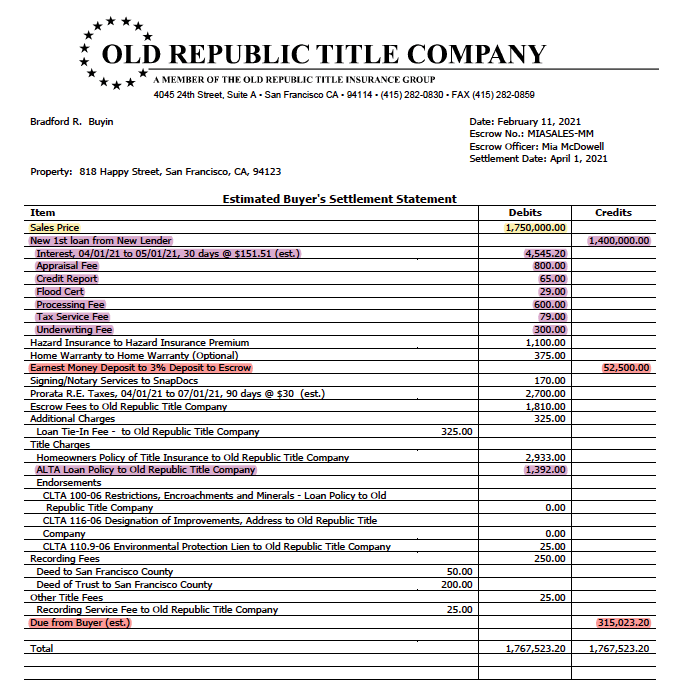

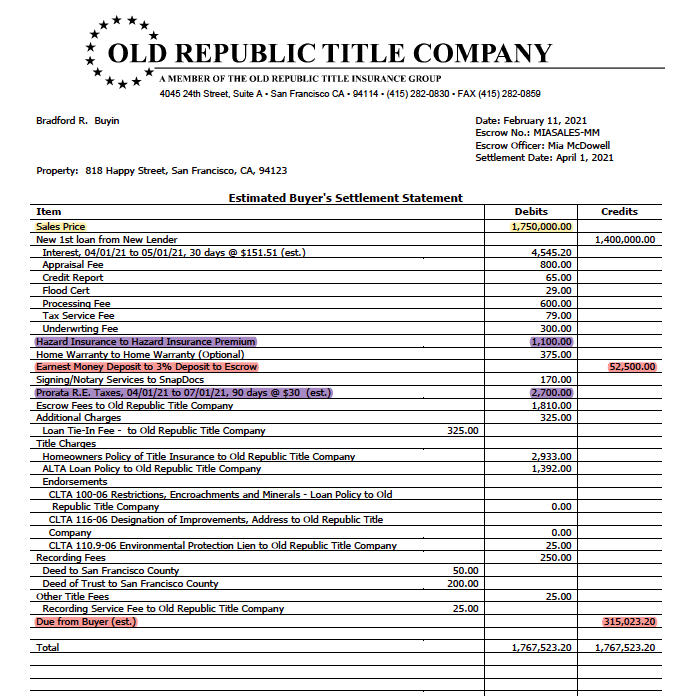

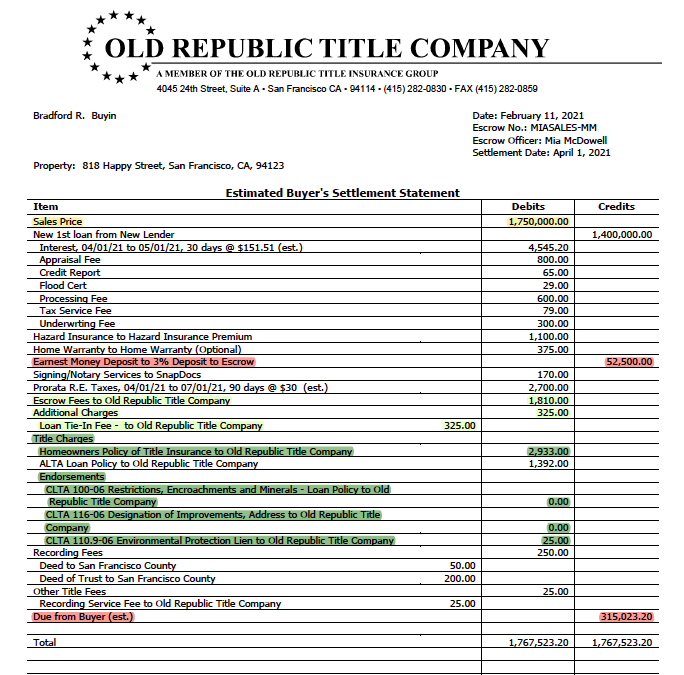

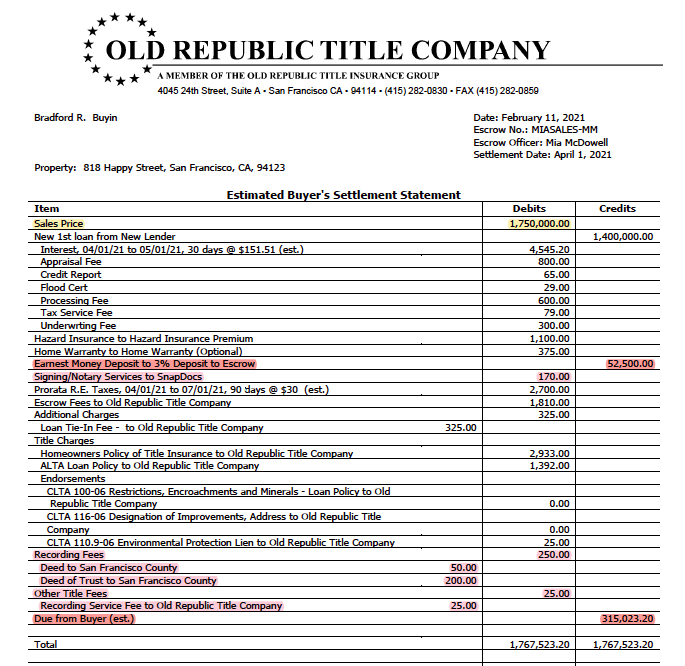

Buyer Estimated Settlement Statement – Highlighted by Closing Cost Type

An easy way to understand your closing costs is to group them:

- lender loan charges (lavender)

- tax and insurance pre-payments (purple)

- title and escrow charges (light green and green)

- other costs, fees, or credits (pink)

It’s an overwhelming document, so let’s break it down with each section highlighted for ease of understanding.

Buyer Loan Charges

Money isn’t cheap! All of the charges associated with the new loan will be summarized in this section. For a buyer with one loan, this is a pretty typical set of charges. If you are paying any points for your loan, that fee will be included in this section. This buyer did not choose an impound account (the bank will pay their insurance and taxes on their behalf), which is typical. San Francisco buyers usually choose not to have an impound account and pay property taxes and insurance on their own.

I’ve placed the title policy for your lender that you purchase on their behalf as a buyer loan charge, because if you don’t have a loan you don’t buy a lender their own title policy. Lender title policies are based on the loan amount, not the purchase price. Lender title policies last for as long as the loan is in effect on the house; if you refinance, you will buy a new policy for the new lender.

Taxes and Insurance

Regardless of the number of days in the month the deal closes, escrow companies prorate costs based on a 30-day month. Property taxes and HOA fees in condos are the two items most likely to be prorated on a buyer’s settlement statement. The buyer and seller will either be credited or debited for property taxes based on when the closing falls in the tax year.

Title and Escrow Charges

Title and escrow charges are grouped together in SF because it’s a title company usually provides escrow services in addition to title insurance. Your two typical costs are your owner’s title insurance policy, and the escrow fee. The cost of the title insurance policy is based on the cost of the home, while the lender’s policy (see buyer loan charges) is based on the size of the loan.

The owner’s title insurance policy lasts as long as you own the property.

Other Fees, Costs, and Credits

Finally, we’ve got everything else. From estimates to recording fees, charges from building or community homeowner’s associations (HOAs), to miscellaneous charges, insurance policies, home warranties, and anything else that doesn’t fit elsewhere.

Balance Due FROM Buyer

Once the buyer’s deposits and loans have been credited to the escrow, and all the debits added up as well, the estimated balance due from the buyer shows the remaining money needed to close the transaction. The balance due is equal to the remainder of your down payment and all of the closing costs as listed on the estimated settlement statement.

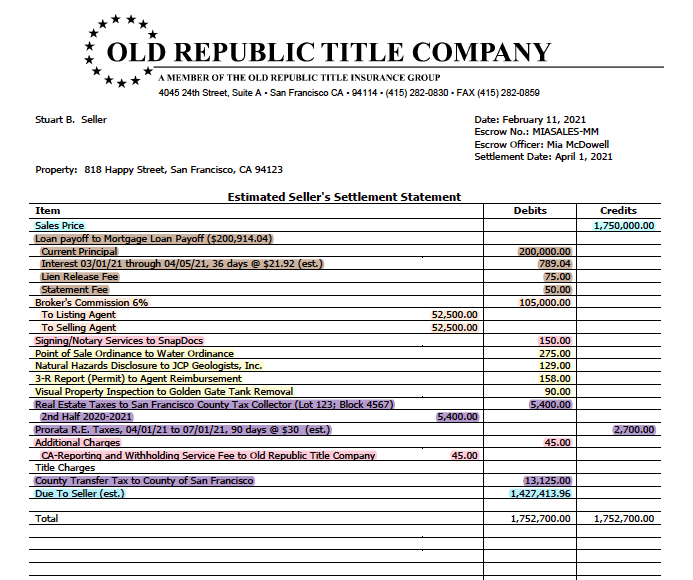

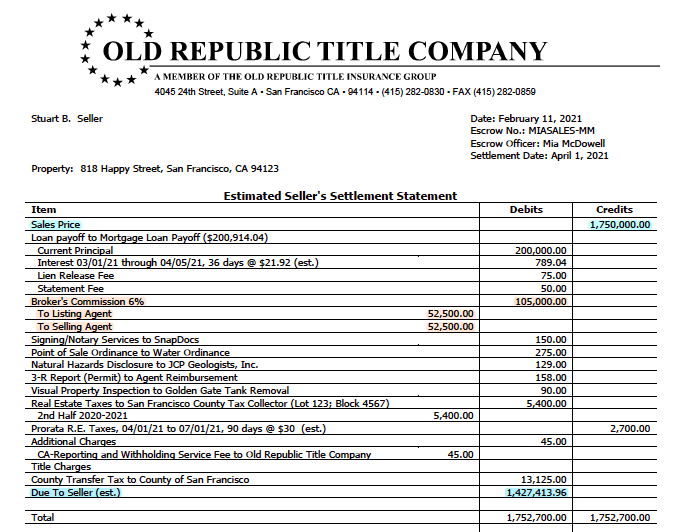

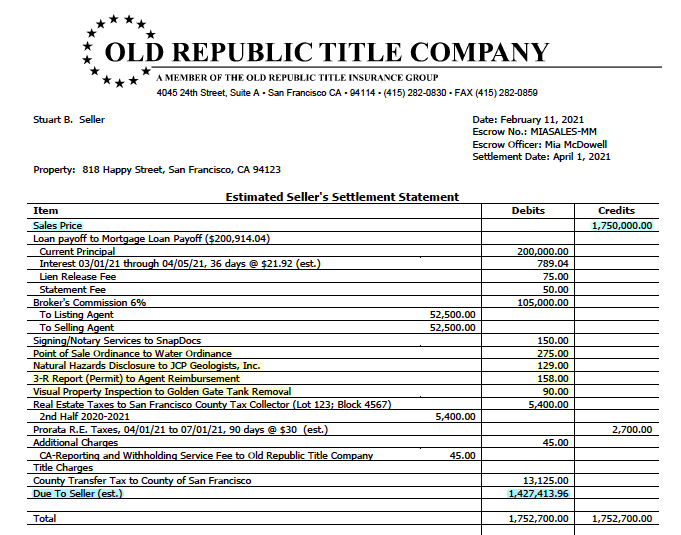

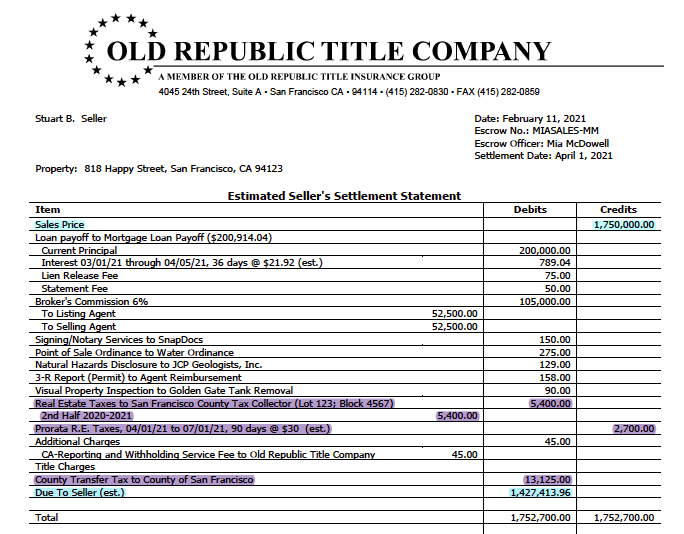

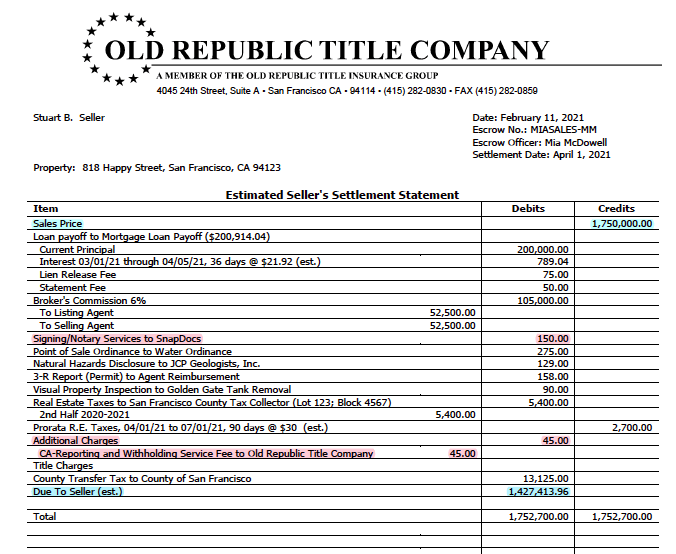

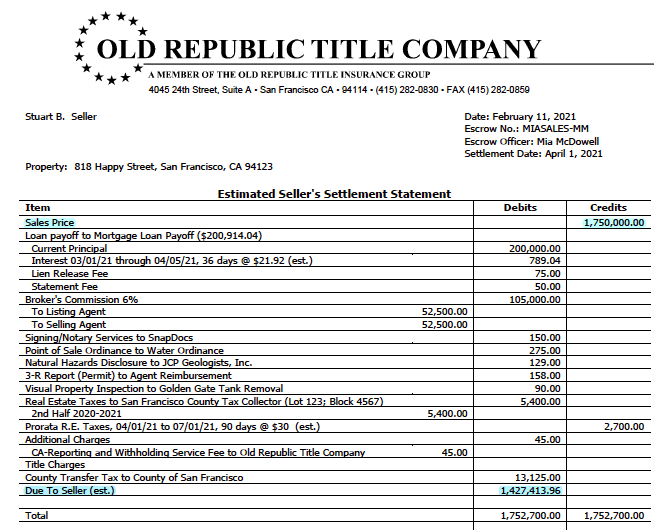

Seller’s Estimated Settlement Statement – Highlighted by Seller Closing Cost Type

Typical seller costs are

- current mortgage loan payoff (brown)

- mandated reports/inspections/documents (yellow)

- real estate commissions (salmon)

- property and transfer taxes (purple)

- miscellaneous (pink)

Seller statements are typically shorter than on the buy side, but that isn’t always the case. Either way, let’s break it down in detail for what a seller should typically expect to see for each of these categories.

Seller Loan Payoff

Typically the biggest “charge” on a seller statement is the payoff for their existing mortgage loan. Payoffs typically consist of the unpaid principal, estimated daily interest charges to closing date, and lender admin fees like the “I’m giving you this information” fee or others.

Real Estate Commissions

Regardless of the agency relationship (buyer/seller/dual agency), sellers typically pay the entire real estate commission for both the buyer’s real estate brokerage and the seller’s real estate brokerage.

Mandated Inspections, Reports & Documents

There are a variety of point of sale mandates and reports that are required by city, county, state and federal laws related to real estate. In this example, payments for the SF water ordinance, state natural hazard disclosure report, city of SF 3R report, and a visual tank inspection (not a technical mandate, often a good idea) are collected from seller and reimbursed/paid to appropriate provider.

Seller Taxes – Transfer & Property

Property taxes are pro-rated based on a 30 day month. Depending on where the sale falls in the property tax calendar, taxes may be collected from or credited to the seller. In this example, the seller has fully paid the second installment and is receiving a credit from the buyer for the period of time the buyer is estimated to own the property in the tax period.

Sellers in San Francisco also typically pay the real estate transfer tax, which is a sales tax on real estate by a different name that goes to your county (and possibly city) treasurer to support your local government’s operating fund. In new construction, developers in San Francisco typically negotiate for buyers to pay this and sometimes it is negotiable depending on market conditions for new construction.

Other Seller Charges

Sellers typically have a few miscellaneous charges for reporting, signing, and other admin/compliance fees that are usually no more than several hundred dollars.

Due to Seller

Show me the money, as they say. After all seller costs are deducted, this is the estimate of the amount the seller will receive net of all sale costs (excluding state/fed taxes that are collected and calculated elsewhere).

It’s Just An Estimate!

Finally, it is important to remember that all of the charges in the closing statement are estimates!

Things often adjust based upon the actual closing date (namely, tax prorations and accrued interest). Escrow agents can close a transaction with excess funds, but they cannot close a transaction that does not have enough money in escrow to cover all costs, so escrow agents will generally estimate generously and then immediately refund any excess estimates after the escrow has closed.

The buyer and seller will receive an updated final settlement statement once the transaction has closed along with the proceeds due to seller or any refund due to buyer.