Pros & Cons of Prop 19: Property Tax Portability

Voters approved Proposition 19 in 2019, and the property tax portability law went into effect in February of 2020. Proposition 19 offers homeowners over the age of 55, homeowners that are severely disabled, and homeowner’s that have been victims of a wildfire or other natural disaster the ability to take their existing tax basis and use it as the basis for a new home.

Tax Basis, What’s That?

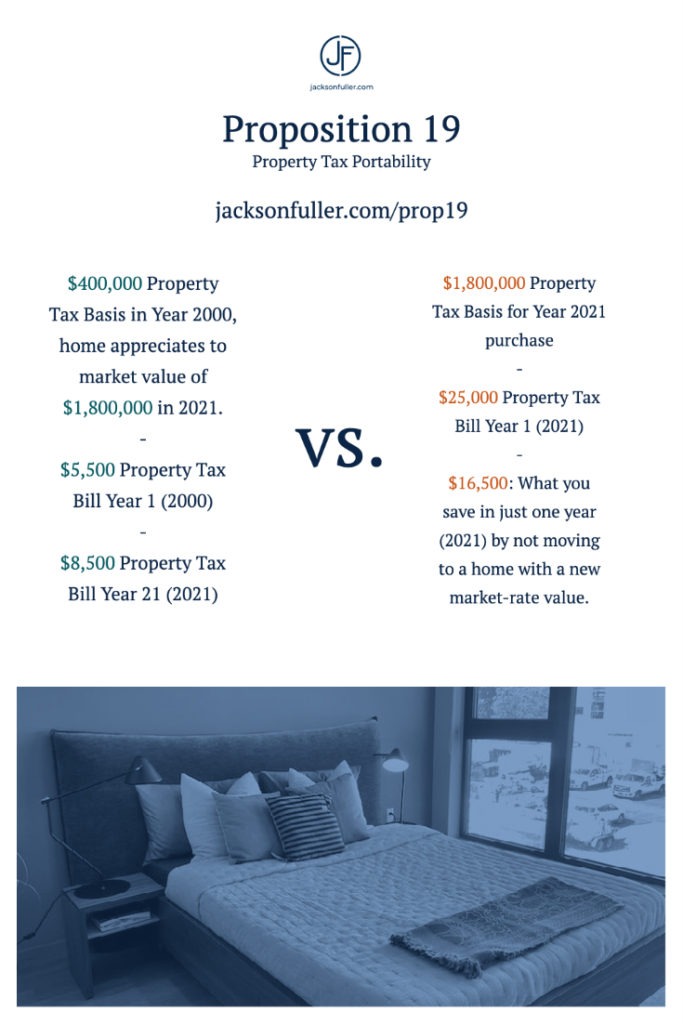

California voters approved Prop 13 in 1979, a dramatic and controversial proposition that limits property tax increases. Prop 13 sets property value – for the purposes of property tax valuation – at the property’s purchase price, and that the initial valuation can not increase more than 2% maximum per year. If you bought a home in San Francisco in the year 2000 and it cost you $400,000, your initial tax basis is $400,000. Your first year tax bill will be about $5,500 before mello-roos and other add-ons. Nothing dramatic to see, yet.

Fast forward to the year 2021 and your home is now worth $1,800,000. But the tax assessor is still using your initial basis compounded at no more than 2% per year which means your 2021 tax bill for a house worth 1.8 million will be only about $8,400. Which is over $15,000 less than the market rate assessment for that same 1.8 million dollar home with a tax basis of roughly $25,000. As you can see, Prop 13 created a powerful incentive to stay put.

Prop 66/90

Legislators and voters approved two amendments to Prop 13 over the years. They were attempts to create portability and allow older homeowners to downsize as they aged and not be penalized with a massive new tax bill. They didn’t accomplish much because it required reciprocal agreements at the county level, which only a handful of counties even entered in to and on top of that it required that the replacement property be the same size or smaller. Prop 66 and Prop 90 failed, for the most part, at creating portability.

Meet Prop 19

Approved by voters in 2019 and in effect after Feb/April of 2021, this proposition replaces Prop.66 and Prop 90 with a new portability scheme that works throughout the entire state of California without needing prior agreement at the county level.

In English, that means qualified homeowners can now sell their home and transfer their existing tax basis with them anywhere in the state of California. This is an enormous improvement over the old system that only allowed for in-county transfer of tax basis unless counties agreed to reciprocate, which they almost never did.

Prop 19 also eliminates the replacement home size restrictions in Prop 66/90, so that homeowners using the benefits of Prop 19 can buy a home of the same size or a smaller or larger home without having to worry if they will be able to transfer their property tax basis.

Who Qualifies for Prop 19’s Benefits?

Proposition 19 applies to three groups of California Homeowners:

- Homeowners over the age of 55

- Any severely disabled homeowner

- Any homeowner in a natural disaster or wildfire.

How Does Prop 19 Work and How Much Will it Save Me?

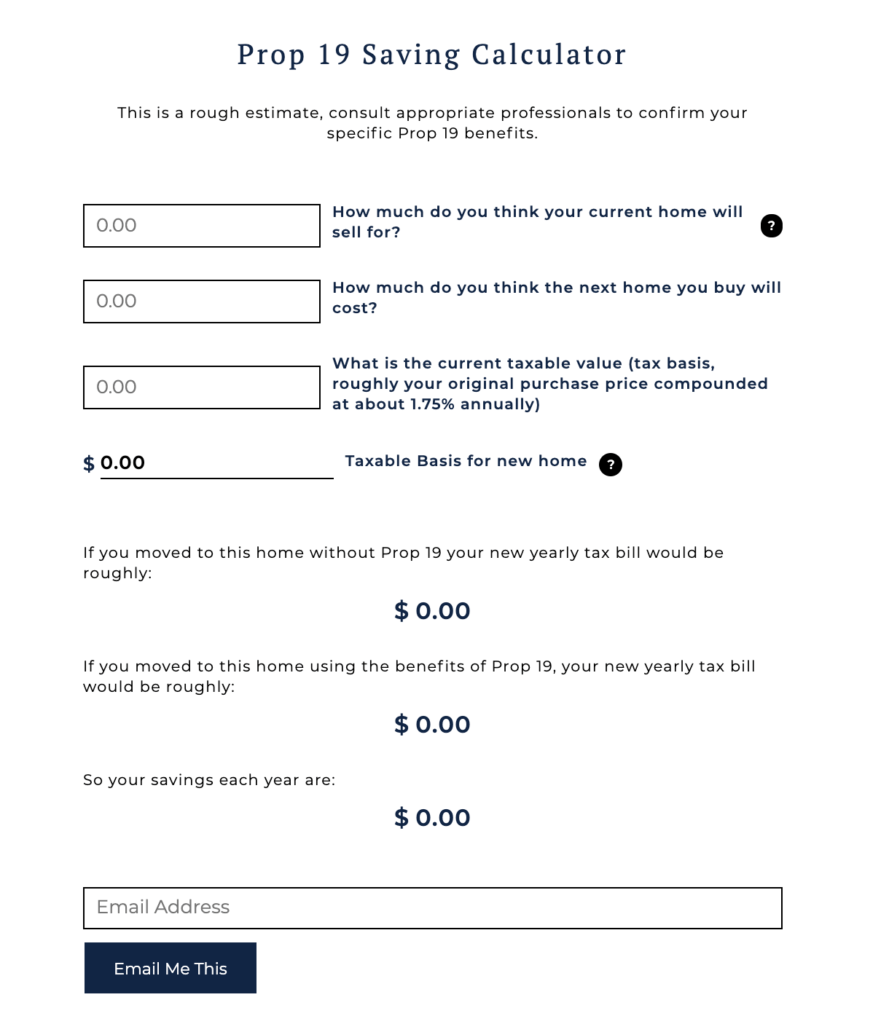

We’ve created an interactive Prop 19 Tax Savings Calculator to help you understand how much Prop 19 may save you because of property tax portability.