Basic requirements for Prop 19 Property Tax Portability

Age 55 or over

– or –

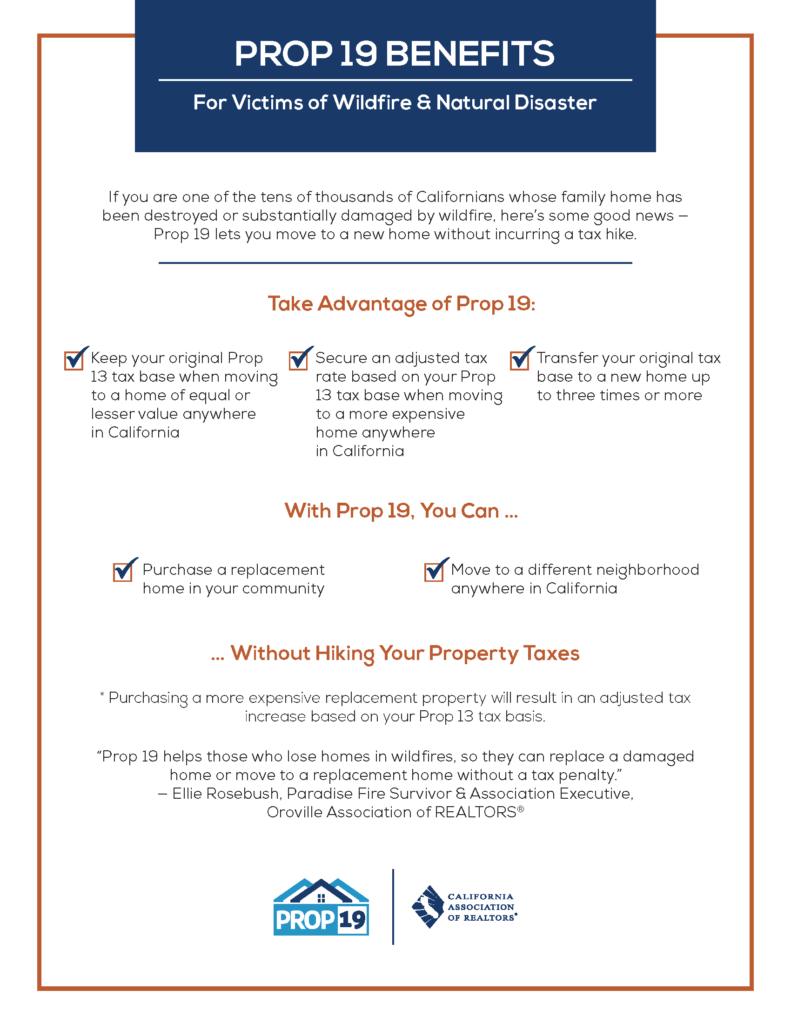

your home has been substantially damaged by wildfire or natural disaster

– or –

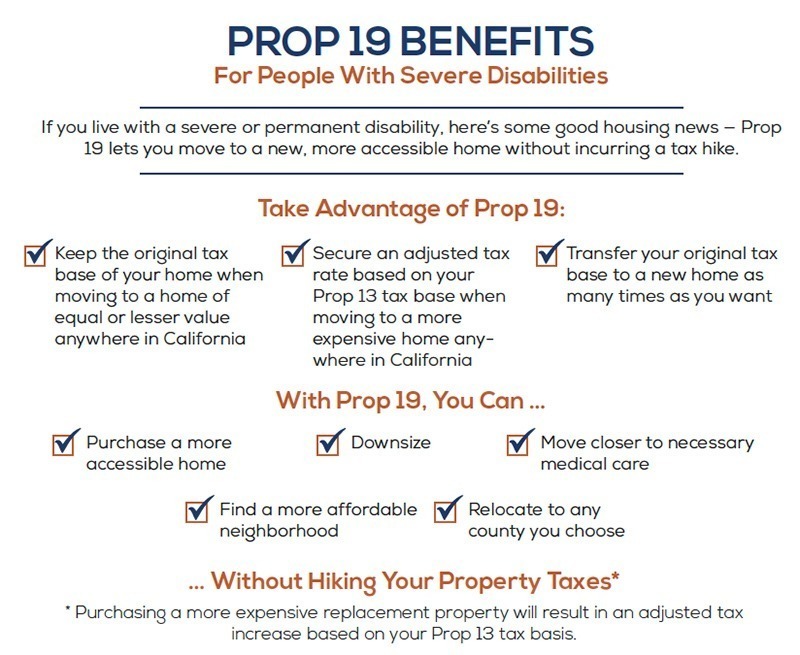

you are severely disabled

What it Allows

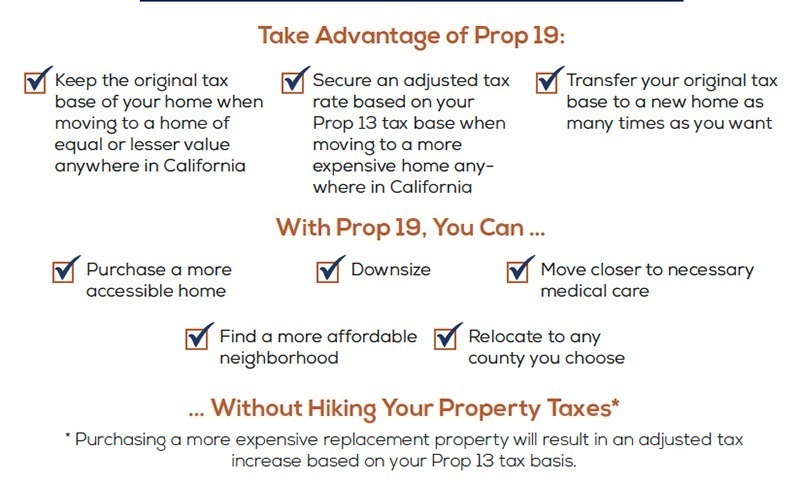

If you meet one of the above three criteria, you may sell your home (take an insurance settlement) and purchase a replacement property anywhere in the state and keep your existing historic (typically low) tax basis with you to a new home anywhere in the state of California.

For Victims of Wildfire & Natural Disaster

For All Homeowners over the Age of 55

For the Severely Disabled

Anywhere?

Correct. You can stay within your existing county, or move anywhere in the state. This is a change from the old system known as Prop 60/90 that allowed for the transfer of an existing tax basis between counties that had agreed to do so. During the decades this law was in effect most counties did not agree to exchange tax basis for properties in other counties so it was a a nice idea that basically never happened.

Is There A Limit to How Much Can My New Home Cost?

Not Anymore! Under Prop. 19 there are no restriction on the size or price of the replacement property. This is another major change between the new Prop 19 laws and the old Prop 60/90 system. Under the old system, the replacement property had to be of equal or lesser value and of equal or lesser size. Both of those restrictions were eliminated by California voters with the passage of Prop 19 in 2019.

What Could My Tax Saving Be?

If your replacement property is the same or less than your existing home, then the entire tax basis of the original principal residence (OPR) transfers to the new property, regardless of size or location in the state of California.

The tax basis for your new home will be calculated using the following formula, for which we have created a handy calculator at the top of this page.

What About Intergenerational Transfers?

Prop 19 changes the laws about this as well. Under Prop 19, a principal residence (including farms) may be passed on to owner occupier children or grandchildren and will retain same tax basis unless the current tax value of the home at the time of death is more than one million dollars greater than the home’s original tax basis. Under the old law, you could transfer the basis for a primary residence and up to one million dollars in other property.

What Does This Mean For Me?

If you’ve got questions after reading this, we hope you’ll get in touch at your earliest convenience!